Strategies Used by Criminal Groups and Terrorists and Federal Efforts to Combat Them

Fast Facts

We reviewed how transnational criminal organizations and terrorist groups traffic goods such as illegal drugs, engage in human trafficking, and launder money. We also looked at the information sharing used to help detect these activities.

Responsibility for combating trafficking is spread across multiple federal agencies. Agencies collaborate via task forces that share information and resources with each other, the private sector, and foreign counterparts. The U.S. Treasury Department, for example, shares information with more than 160 international financial intelligence agencies.

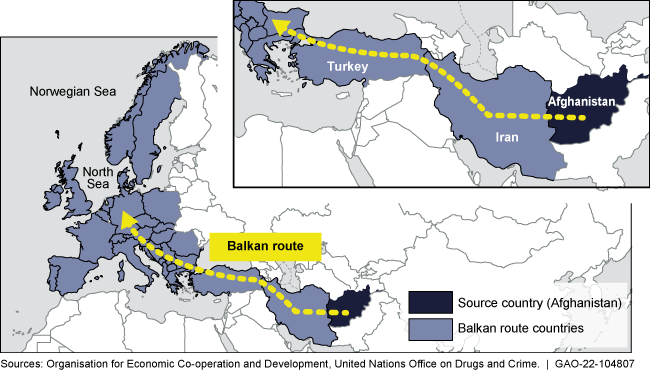

Criminal groups move heroin and more from Afghanistan to western Europe via the Balkan route.

Highlights

What GAO Found

Federal agencies and others have reported that money laundering strategies used by transnational criminal organizations and terrorist groups include sophisticated techniques such as phony trade transactions or purchase and resale of real estate or art. Such techniques can involve the services of professional money laundering networks or service providers in legitimate professions, such as complicit lawyers or accountants. For example, lawyers or accountants can create shell companies (entities with no business operations) to help criminals launder illicit proceeds. Transnational criminal organizations and terrorist groups also continue to smuggle cash in bulk or transmit money electronically across borders.

Federal efforts to combat trafficking and money laundering incorporate multiple collaborative and information-sharing mechanisms and include the private sector.

- Law enforcement agencies collaborate through task forces in which they share information and analytical resources to aid in the investigation and prosecution of drug and other trafficking-related crimes.

- Federal agencies share intelligence with foreign counterparts. For example, the Financial Crimes Enforcement Network (FinCEN), a bureau of the Department of the Treasury, shares information with more than 160 international financial intelligence agencies.

- FinCEN collaborates with law enforcement agencies to share information with financial institutions on “red flags” for trafficking, which institutions can use to identify and report suspicious transactions (see box below).

- FinCEN also coordinates a voluntary program that allows financial institutions to share information with one another to better identify and report suspicious activities that may be related to money laundering or other illicit financing.

Examples of Human Trafficking “Red Flag” Indicators Provided to Financial Institutions

- Involvement of a third party who speaks for the customer, insists on being present for transactions, or acts aggressively toward the customer.

- Frequent customer transactions from different U.S. geographical regions.

- Transactions that are inconsistent with a customer’s expected activity.

- Customer accounts that share a telephone number or other identifiers with escort agency websites or commercial sex advertisements.

- Frequent sending or receipt of funds via cryptocurrency to or from internet addresses associated with illicit activity.

Source: GAO analysis of Financial Crimes Enforcement Network information. | GAO-22-104807

These mechanisms help address some of the challenges involved in combating trafficking and money laundering, which include the increasingly sophisticated strategies of criminal and terrorist groups and the fragmentation of responsibility for anti-trafficking efforts among many federal agencies.

Why GAO Did This Study

FinCEN identified trafficking activity of transnational criminal organizations and terrorist groups as among the most significant illicit finance threats facing the United States in its 2021 Anti-Money Laundering and Countering the Financing of Terrorism National Priorities. Congress included a provision in the National Defense Authorization Act for Fiscal Year 2021 for GAO to review trafficking and related money laundering and federal efforts to combat them.

Among its objectives, this report describes what is known about the money laundering strategies of transnational criminal organizations and terrorists and information-sharing efforts among federal agencies to combat trafficking.

GAO reviewed documentation from Treasury and other federal agencies, international and nonprofit organizations focused on trafficking or money laundering, scholarly journals, and prior GAO work. GAO examined federal guidance to financial institutions and interviewed federal agency officials; experts in trafficking, money laundering, and use of data technology; and representatives of trade groups for lawyers and accountants. GAO also interviewed five groups of financial institution representatives about identifying trafficking-related suspicious activities.

Article credit: https://www.gao.gov/products/gao-22-104807