Will the e-money boom make the UK a hub of money laundering?

openDemocracy investigation finds that international money launderers are moving into Britain’s e-money business – with the Financial Conduct Authority’s official seal of approval.

Article By David Leask Richard Smith

COVID is killing cash. Even as lockdowns loosen, consumers are turning away from notes and coins like never before.

A survey in April found four out of five Britons – many forced to do all their shopping online – were considering new digital ways to pay.

Some are turning to ‘e-money’, with a raft of new money-handling products aiming to challenge industry leader PayPal.

From a health point of view, this is safer than handling cash and visiting shops. But, anti-corruption researchers warn, the boom in e-money poses another risk: money-laundering.

There are already concerns that regulators, including British ones, failed to keep close tabs on German payments giant Wirecard, which went bust two weeks ago.

The UK’s watchdog, the Financial Conduct Authority (FCA), for a few days even froze some £500 million in customer money at the firm’s British subsidiary, while it made sure the money actually existed.

Now an investigation by openDemocracy reveals UK-regulated electronic money institutions, or EMIs, are being touted as a replacement for networks through which billions of dollars of dark money moved in and out of the former Soviet Union.

Our research follows individuals and institutions who were linked with Baltic banks that were fined for enabling – or failing to prevent – industrial-scale money-laundering. We’ve found that some are moving into the British e-money business, complete with a stamp of approval from the FCA.

And we have found an open Russian-language internet trade in UK shell companies with EMI accounts, EMI licences and even an anonymous EMI provider on offer for £1 million.

Anti-corruption group Transparency International believes the sector poses an emerging threat in the battle to stop criminals from cleaning or moving their dirty money.

The next Russian laundromat?

For years corrupt officials, criminals and tax-avoiding entrepreneurs used anonymously held ‘shell’ companies (often registered in the UK or its territories) to open bank accounts in the Baltic states.

This relatively simple scheme enabled some of the biggest laundering schemes ever exposed, such as the multi-billion-dollar ‘Russian laundromat’, revealed in 2014, and similar pipelines for dark or dirty money out of Azerbaijan and Ukraine.

The huge flow of money through this machinery is thought to have reduced to a trickle since a 2018 crackdown in Latvia on banking for people who do not live in the country.

But now an alternative route has been suggested: EMIs, including those registered and regulated in the UK.

There is a cottage industry advising people and business in the former Soviet Union about offshore structures. It is pretty frank about this shift to British EMIs.

Back in 2018 the Russian-language site Zapiski ob Ofshorakh (‘Notes on “offshores”’) set out the pros of various EMIs, including UK-regulated ones. And its explanation for why it was doing so could not be blunter.

It said: “In connection with the mass closures of non-resident bank accounts in Baltic states – and the growing difficulty in working with foreign banks – some entrepreneurs are looking to open corporate accounts in payment systems.”

The message: it is now harder to move money – including dirty or untaxed money – through shell firms and Baltic banks, so try EMIs instead.

The site sells shell companies, including the now-notorious Scottish limited partnerships or SLPs, dubbed Britain’s “home-grown secrecy vehicles” by Transparency International.

One of the site’s specialists even boasts in a recent video how clients can set up an SLP and then have a credit card issued by an EMI sent to the firm’s proxy address in Scotland and from there on to Russia or Ukraine.

Moreover, other sites offering offshore services to a largely Russian-speaking market are going further.

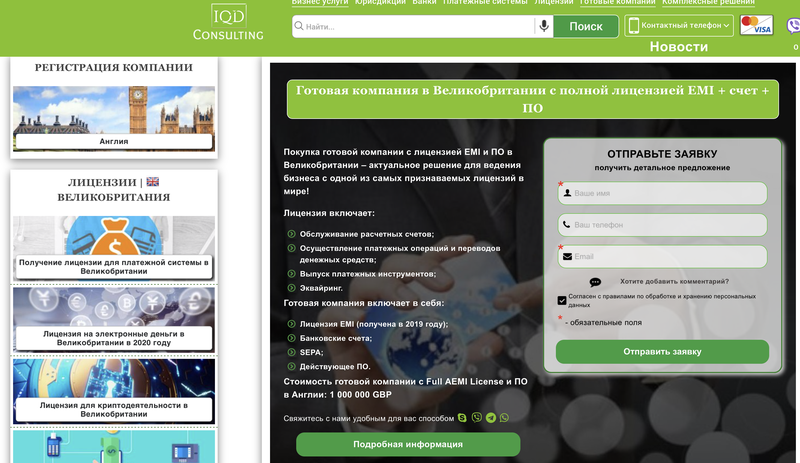

IQD Consulting has been offering to sell an unnamed British company complete with an e-money licence. The price tag? £1 million.

The vendor also markets British and international shell companies, including Scottish limited partnerships, complete with accounts at British banks or EMIs.

IQD did not respond to a request from openDemocracy for comment. It did, however, remove its English-language offer for the e-money company after we got in touch.

The website is owned by a limited partnership called Lacerna registered in Dublin. Irish limited partnerships do not need to declare a beneficiary so there is no way of knowing who owns or operates the site.

The Latvian connection

They were the bankers who helped North Korea develop ballistic missiles: three financial institutions in Latvia were fined after an FBI probe exposed their lax controls had let the world’s most secretive state get around sanctions.

Now people who owned or worked for those banks are getting what – to outsiders at least – looks like an endorsement from the British state, a kind of financial kitemark: registration from the FCA as EMIs.

Latvian banking, specifically non-resident banking, was widely seen as a breach in international defences against money laundering. It suffered scandal after scandal until Latvia, under pressure from the EU and US, moved to stop its banks giving accounts to anonymously owned shell companies or dummy corporations, not least from the UK and its overseas possessions.

The great crackdown on Baltic non-resident banking in 2017-18 coincided with a gradual migration of some of its institutions and personalities to the UK’s e-money industry.

One Latvian bank, Rietumu Banka, already has links to the British Isles. One of its three owners is Dermot Desmond, a leading shareholder of Scottish football champions, Celtic.

The bank has been fined by Latvian regulators for failures in money-laundering controls. It is also currently appealing against a criminal conviction – and penalty of €80 million – from a French court for enabling mass tax evasion.

Now its shareholders own a British EMI, Decta, and Rietumu banka provides clearing services for it and five more.

Decta told openDemocracy that it “acts in strict accordance with the requirements of FCA”.

It added: “We regularly pass anti-money-laundering (AML), Anti-Fraud, Know Your Customer and Combating the Financing of Terrorism audits held by Visa, Mastercard and big-four auditors, proving Decta to be complying with all latest AML standards.”

Financial crime continues to be an area of supervisory focusFinancial Conduct Authority

Another Latvian bank repeatedly fined for money-laundering failures was Baltikums, now called BlueOrange. It was one of three Latvian institutions punished by regulators after its accounts were used to breach EU and US sanctions against North Korea. It was one of the banks used to process payments under the multi-billion-dollar Russian and Azerbaijani laundromats, according to investigations carried out by the Organised Crime and Corruption Reporting Project and its partners.

The chairman and co-owner of BlueOrange, Alexander Peshkov, is listed in British corporate filings as the person of significant control of Bilderlings Pay, a British EMI licensed by the FCA. Offshore business advice website Zapiski ob Ofshorakh, among others, recommends Bilderlings Pay as an alternative to a Baltic bank account.

Bilderlings did not respond to a request for comment. Last year accounting giant BDO announced it had reviewed the e-money provider’s anti-money-laundering procedures. BlueOrange has said it has improved such controls since 2017.

Other veterans of the Baltic non-resident banking system are also setting up British e-money firms or working for them.

British-educated Latvian Artjoms Dozorcevs, who used to work at Rietumu, set up British EMI AltPay in 2018. He hired another Latvian banker, Andris Ovsjaņņikovs, as head of his client relationship department. Ovsjaņņikovs had previously worked for ABLV, a bank stripped of its licence in 2018 after the US Treasury found that it had “institutionalized money laundering as a pillar of the bank’s business practices”. Early this year Ovsjaņņikovs was arrested as part of a €50 million laundering investigation into ABLV.

Dozorcevs believes the risk of cross-contamination of bad anti-money-laundering practices from Latvian banks to British EMIs is “minimal”.

In an email to openDemocracy, he described Ovsjaņņikovs’ arrest as a “devastating turn of events”.

He added: “As soon as I heard the news our business relationship was terminated indefinitely.

“He has now been released with charges dropped but we do not plan to renew our cooperation.”

Dozorcevs said his small EMI avoided the hurdles of traditional banking but did not compromise on anti-money-laundering checks.

Several British EMIs have appointed people who were responsible for anti-money-laundering work at Latvian banks to do the same or similar jobs.

Take Paystree. This EMI has Evija Meimane as a director. She has worked for no fewer than four of the Latvian banks fined over money-laundering, including a spell lasting from 2010 to 2014 in charge of monitoring customer payments at Trasta Komercbanka. This bank is currently challenging the 2016 revocation of its licence over alleged failure to prevent the laundering of up to $13 billion by its customers, between 2010 and 2014: the notorious ‘Russian laundromat’. Paystree did not respond to requests for comment.

Global Star Finance, another EMI, has a director and head of anti-money-laundering who held compliance posts at four banks fined for lax money-laundering controls. The official, Ingreta Jansone, told openDemocracy the EMI was “not doing active business at the moment, and wouldn’t want to comment”.

British EMI Dzing this spring appointed Iveta Kerpe as its chief financial officer after a career in Latvian banking, including jobs at two banks sanctioned for not controlling money-laundering carefully enough. In the aftermath of a banking fraud in Moldova, in which $1 billion was spirited away to accounts at ABLV and PrivatBank Latvia, Kerpe was fined and ordered to stand down from her board position at the Latvian branch of Ukraine’s controversial PrivatBank. PrivatBank was one of the three institutions fined after the North Korea probe.

A spokesman for Dzing said the business – which aims to facilitate small cash transfers between family members – was not yet in operation.

He said compliance was one of the largest teams in the firm and added: “We do not provide banking for companies – our current proposition at the moment is for retail customers only. We are regulated by [the] FCA and intend to comply with all aspects of UK and EU financial regulation, including anti-money laundering procedures.”

Policing electronic money

The UK’s watchdog, the FCA, has previously ranked the laundering threat from e-money as “medium”. Transparency campaigners and opposition politicians have long accused Britain and its regulator of taking a light-touch approach to financial markets. However, the UK’s image as a state with rule of law and a reputation for fair play is also a vital part of the marketing of EMIs aimed squarely at the former Soviet Union.

The FCA licenses EMIs – who have to show that their executives and owners are respectable – and can shut down those which break rules. A licence is not an endorsement, but it can be marketed that way.

The regulator does act against EMIs. This February ePayments Services Limited – which uses Rietumu Banka for clearing – suspended its accounts, around one million in total.

The company, in a statement on its website, said: “This decision was taken following a review, by the FCA, of ePayments’ anti-money-laundering systems and controls, which identified weakness that required remediation.”

Industry sources have suggested it was over-exposed to online businesses with a high risk of claims for the return of payments, such as online porn and gambling.

The business, which says it has no overall controller, offers services in English and Russian.

We have been waiting impatiently for Brexit all year because – and this is good news – this island will probably become more ‘offshore’Ivan Zhiznevskiy

Last year the FCA forced the UK subsidiary of another e-money provider, Allied Wallet, into liquidation after the firm’s parent settled US charges that it had helped clients defraud consumers of $110 million in scams and pyramid schemes and illegal debt collections. Allied Wallet, which never admitted or denied the claims, was accused of helping to buy British shell companies for its clients.

The firm’s chief executive, Andy Khawaja, was last year charged in the US with alleged involvement in illegal campaign contributions to Hillary Clinton’s 2016 presidential campaign as part of an influence-peddling scheme. Khawaja, a Lebanese-American who also made a donation to Donald Trump’s inauguration, was essentially accused of providing proxies, so-called “straw” donors, to make campaign contributions on behalf of those who wished to hide dark money flowing into US politics.

He was charged alongside another Lebanese-American, George Nader, an informal diplomat with ties to the Abu Dhabi royal family who advised the Trump administration and later was a witness in Robert Mueller’s Trump-Russia investigation. Last month he was convicted in the US on child sex charges.

The FCA said it could not comment on individual cases or companies highlighted by openDemocracy. However, in a statement, it said: “We expect payment firms, including e-money institutions, to meet their regulatory responsibilities and it will act swiftly where firms fail to meet requirements.

“Financial crime continues to be an area of supervisory focus to ensure that payments firms have appropriate systems and controls in place to minimise the incidence of accounts being used for fraud, money laundering or other financial crime.”

Under FCA rules anyone running an EMI has to be a ‘fit and proper person” and that directors and managers should be of good repute and have the necessary know-how.

This, it is understood, would apply to anybody who bought an EMI-licensed company off the shelf.

Offshoring the UK

COVID does appear to be driving traffic to e-money and other cashless and digital payment systems. One Irish e-money provider has said its turnover has doubled under the lockdown.

However, some in the e-money industry are looking at what they see as another opportunity to grow: Brexit.

Late last year, the founder of e-money firm 3S Money Club – which styles itself as an “online-bank” and uses Rietumu for clearing – set out his vision for a freewheeling UK free of Brussels red tape.

According to a Russian-language report on Rambler News, Ivan Zhiznevskiy said the UK would have greater “ofshornost” (‘offshore-ness’) after it left the EU. He said: “We have been waiting impatiently for Brexit all year because – and this is good news – this island will probably become more ‘offshore’.”

Article Credit: https://www.opendemocracy.net/en/dark-money-investigations/will-e-money-boom-make-uk-hub-money-laundering/?