The Quiet Man in Stockholm Who Laundered China’s Oil Money for Iran

This article from the Organized Crime and Corruption Reporting Project (OCCRP) and Sweden’s Sveriges Television (SVT) is part of an investigation in which Courthouse News Service and NBC News are partners.

By all outward appearances, Hatam Khatoun Nema was a small-time money changer working from a nondescript office in Järfälla, a workaday Stockholm suburb.

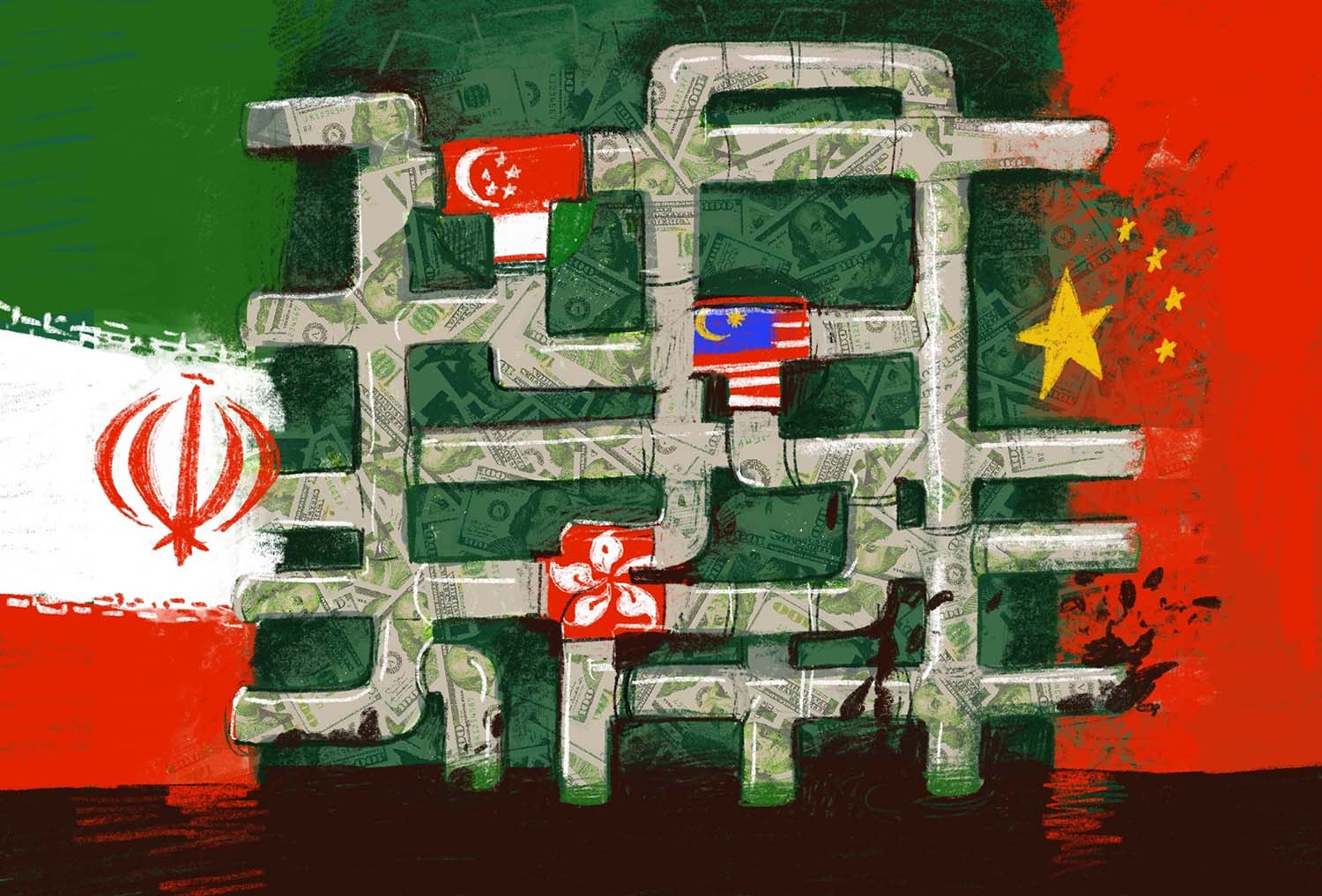

In reality, the Swedish-Iranian businessman ran an obscure Hong Kong company, H M E A CO., LIMITED, that laundered hundreds of millions of dollars through a web of shell companies and businesses stretching from Singapore to Panama.

A major customer of Nema’s operation was the Islamic Republic of Iran. Between 2012 and 2014, he helped move payments for the oil that Iran sold to China, its most important trading partner and geopolitical ally.

The network allowed Chinese energy companies to hide the oil payments, which could bring U.S. scrutiny and possible sanctions for violating restrictions on dollar-based trading with Iran.

To circumvent crippling international economic sanctions aimed at stifling its nuclear program, Iran has long engaged in subterfuge to continue oil exports. Iran’s efforts to access the proceeds of its oil exports have pushed large swathes of its trade and foreign exchange market underground, entrusting enormous wealth to international criminal networks.

The illicit money flows have made massive fortunes for those willing to take risks.

Reza Zarrab, a Turkish-Iranian money launderer who became infamous after his 2016 arrest in Miami, pleaded guilty to bank fraud and money laundering in moving money for Iran. For years Zarrab rubbed shoulders with Turkey’s elite, including President Recep Tayyip Erdoğan, and flaunted outrageous wealth and an excessive lifestyle around the world.

But while Zarrab and his wife, a famous Turkish pop star, lived in the limelight, no one noticed the likes of Nema, whose low-key operation from a gray bungalow on the outskirts of Stockholm did much the same work for the same client.

Unlike Zarrab, Nema has faced no charges for helping Iran evade sanctions. He remains at large.

Covert Networks

OCCRP, Sweden’s Sveriges Television (SVT), the U.S. Courthouse News Service, NBC News, and other media partners spent months examining financial records, including bank transactions from the U.S. investigation of Zarrab, of Turkey’s state-owned Halkbank, and of the bank’s former director, Mehmet Hakan Atilla, who helped Zarrab move billions of dollars for Iran. It’s unclear if U.S. officials were even aware of Nema’s network. Prosecutors declined comment for this story.

The records reveal multiple covert financial networks, including Hong Kong-based groups centered on Nema’s HMEA.

He incorporated the company in March 2012, less than a month after President Barack Obama signed an executive order prohibiting U.S.-linked banks from handling most transactions involving Iran.

The pressure was meant to bring Iran to the negotiating table — and it did. In July 2015, the U.S., Iran, China, Russia, the UK, and the European Union announced the Joint Comprehensive Plan of Action, popularly known as the Iran deal, which envisaged an end to Iran’s nuclear activities in exchange for the lifting of economic sanctions.

But even while participating in the negotiations, China continued its dollar trade with Iran through underground networks and proxy companies.

Claiming only HK$10,000 (less than US$1,300) in registered capital, and with no stated business purpose, HMEA moved at least $450 million between 2012 and 2014, the period covered by transaction records obtained by OCCRP.

The money, which flowed through accounts at seven international banks, included at least $100 million in transactions with oil industry-related companies, and at least $130 million in transfers through obscure entities linked to criminal networks and sanction-busting schemes.

Created by company services provider Richful Deyong International Business (China) Limited, HMEA had a prestigious address in Lippo Centre, an iconic skyscraper in Hong Kong’s central business district.

But at least one major bank sent account statements directly to Nema’s home in Stockholm. “What we’re looking at appears to have the characteristics both of money laundering and sanctions evasion,’’ said Ross S. Delston, an attorney and anti-money laundering expert based in Washington, D.C. “It’s difficult to say without a lot more facts, and would require an investigation by law enforcement agencies in multiple countries that might take months or years.”

Sanctions Evasion

Strangled by years of U.S. and U.N. sanctions, the Iranian economy was firmly in the doldrums by 2012. The country’s GDP shrank 7.4 percent that year as a result of a slump in oil exports, a crucial source of government revenue. The Iranian rial collapsed and has never recovered.

To beat the sanctions and move money internationally, Iran turned to various underground networks, including those run by organized crime syndicates. Financial experts say that even the Iranian government may not know where all of its money ended up.

“There is no singular government agency coordinating such sanction-evasion schemes,” said Ali Dadpay, a University of Dallas associate professor of finance who studies China-Iran economic relations. “Different organizations and bodies are involved in different types of schemes in different countries…”

The two countries are now finalizing a multibillion economic and security deal, which could reportedly see massive Chinese infrastructure investment in exchange for discounted Iranian oil.

In many ways, the agreement would simply formalize a longstanding geopolitical alliance.

China takes advantage of Iran’s economic isolation. With little competition, the world’s largest petroleum importer is able to buy Iranian oil at favorable prices and has filled the financial vacuum left by sanctions.

Operations like HMEA’s allow the system to work.

“While the rest of the world shunned dealing with Iran, in China entrepreneurs from the private sector were willing to offer services to move money through China,” Dadpay said.

“Government officials in different sectors are often involved in these efforts. Some of them have been charged by personally benefiting from opportunities offered by the opaque movement of funds,’’ Dadpay said. “But the smuggling networks themselves are often established by small business networks, whose services are used by state actors to move money across borders.”

In July 2013 alone, HMEA transferred at least $100 million between major Iranian and Chinese oil interests.

This includes at least $60 million that HMEA received in a single day from China Best International (HK) Limited, a four-month-old Hong Kong company then controlled by Chinese national Liu Qianting.

The businessman is the current CEO of Zhoushan Jinrun Petroleum Transfer Co Ltd, a company that operates bonded oil storage terminals in China’s Zhejiang province, where cargos are not required to clear customs. Last year, Reuters reported that Zhoushan Jinrun was offloading Iranian crude oil that had been transferred between cargo ships before entering Chinese waters to disguise its origin.

The connections lead to major players. Zhoushan Jinrun is a subsidiary of Herun Group, a private conglomerate controlled by Yu Songbo, who in 2014 made the Forbes “China Rich List” with an estimated net worth of $1.3 billion.

Liu Qianting, Zhoushan Jinrun’s CEO, is also a shareholder in several energy and logistics firms affiliated with Herun Group. Moreover, China Best International, the company that sent HMEA the $60 million, shares an address with a Herun Group Hong Kong subsidiary. China Best was subsequently transferred to a new owner with no known connection to oil. Herun Group did not respond to a request for comment.

At the other end of the oil money pipeline, HMEA made cumulative payments of at least $46 million in July 2013 to International Oil and Design Construction Labuan Ltd., a company registered on Labuan, a Malaysian island known for tight corporate secrecy where Iranian oil shipments destined for Asian markets are disguised.

That company’s ultimate owner, through a company registered in Kuala Lumpur, is Oil Design and Construction Corp, an Iranian state-owned oil and gas company. Two principal directors of an ODCC subsidiary, Maziar Modarres Sadeghi and Majid Malek, also established a Hong Kong subsidiary in March 2012, just four days after HMEA’s incorporation. Both have strong ties to Iranian state energy and shipping interests.

ODCC did not respond to a request for comment.

Several other Chinese energy and shipping firms also transferred money through HMEA, as did other Malaysian entities ultimately linked to Iranian state-backed interests.

The Swedish Rainmaker

Despite HMEA’s immersion in global intrigue, its Swedish-based controlling shareholder, Hatam Khatoun Nema, attracted little notice outside Sweden and Lithuania.

Records show the Baghdad-born Nema lived in a small bungalow in Järfälla, a North Stockholm suburb best known for its large immigrant population and an outlet shopping mall. He also owns an apartment in central Dubai and has Iraqi citizenship.

Nema has run more than a dozen small businesses in Sweden, Iran, Hong Kong, the United Arab Emirates (UAE), Lithuania, and Estonia over the past 20 years, often working with siblings who live in Stockholm.

His first Swedish company, H.M Import and Export Handelsbolag, was incorporated in 2000. It provided money exchange services for a wide range of clients, including the Iranian embassy in Stockholm. In 2006, he co-founded H.M. International Travel AB, a major ticketing agent in Sweden for state-owned Iran Air.

Swedish tax authorities began to suspect bookkeeping irregularities at H.M. Import and Export in 2005, but Nema’s operations escaped serious scrutiny until late 2012, when he was ensnared in a criminal investigation of a business partner, a man named German Frank Kaur. Kaur did not respond to a request for comment.

Kaur’s Estonian construction firm, Tenrent OU, which also had operations in Sweden but was not officially registered there, was suspected of creating a tax evasion scheme for Swedish construction companies. As part of the scheme, HMEA and other Nema companies generated false invoices that were used to launder proceeds through Hong Kong banks.

Swedish authorities who searched Nema’s home in November 2013 found bank statements suggesting HMEA links to Iran — a lead they never pursued. Nema was convicted of serious accounting fraud, however, and went to prison for about 10 months. The Swedish Economic Crimes Authority did not respond to requests for comment.

While Swedish investigators focused solely on tax evasion, authorities in Lithuania cast a wider net. In May 2013, before the raid in Sweden, Nema had established a company called UAB Hameja in Vilnius. A few months later, Lithuanian investigators were alerted to suspicious bank transactions involving fake shipments of Iranian pistachio nuts.

A few weeks after it was incorporated, UAB Hameja opened an account with Siauliu Bank in Lithuania. Over two months, the company received $1.48 million, including $1 million from CAP Industries, a French trader of fruits and nuts.

The nature and amounts of the transactions raised red flags for the bank’s compliance department.

When approached by Lithuania’s Financial Crime Investigation Service, Nema provided bills of lading showing that a ship called Uni Globe had delivered pistachio nuts from Hong Kong to Le Havre, France. He also provided invoices showing that CAP Industries purchased more than 57 tons of pistachios from EKA Group Co Ltd., a Hong Kong company that was part of HMEA’s wider network, and which indicated UAB Hameja as the end beneficiary of the deal. The pistachio payment, he claimed, was essentially a “loan” to his Lithuanian company.

Nema’s story fell apart when Lithuanian authorities determined that Uni Globe hadn’t docked in Hong Kong or France and that the papers were forged.

French authorities subsequently questioned CAP Industries CEO Bruno Giroud, who claimed to have relied on intermediaries to buy pistachios from Iran because of the trade restrictions. Giroud also claimed to have resold the pistachios to two Hong Kong fruit traders. He agreed that Nema’s documents were likely forged.

“We were buying and selling pistachios, but because transactions with Iran were forbidden we had a partner who told us to instead make payments for pistachios to this other company they were using in Lithuania,” Giroud told an SVT reporter in a telephone interview. “Where the money went after Lithuania I don’t know, but we certainly would not conduct such transactions now…”

Lithuanian authorities indicted Nema, who remains a fugitive. Neither Giroud nor CAP Industries were charged with any crime.

In December 2015, Nema was charged with money laundering, false accounting, conducting illegal business activities, and using forged documents. Following his release from prison in Sweden, he was extradited to Lithuania in May 2018. He pleaded not guilty, posted bail, and never went back for further questioning. Lithuania’s prosecutor general did not respond to requests for comment.

HMEA was dissolved by September 2017, but Hong Kong company records show that in May 2018 Nema assumed directorship of another Lippo Centre-based company, Electra Trade Co Ltd, which was incorporated in 2017 by a UAE national of likely Iranian origin.

Nema never returned to Lithuania to face prosecution, and an EU arrest warrant was issued in 2019. His whereabouts are unknown. Attempts to reach him for comment through his family were unsuccessful.

In addition to his own business links to Tehran, Nema has acknowledged a close partnership with a businessman with multiple operations in Iran.

“A scheme that involves hundreds of millions of dollars is beyond the ability of one person to manage,’’ Delston said. “So there would need to be lots of people with lots of specialties and technical skills involved.”

In a statement to a Swedish court, Nema identified HMEA’s “real owner” as his friend and business partner, Ehsan Azarnekou, 39, an Iranian who also holds citizenship in the tiny Caribbean island nation of Dominica. His LinkedIn profile indicates a base in Iran and identifies HMEA as his principal business.

Azarnekou co-founded Red Lantern, a Tehran-based trading and banking company, in 2008. Similar to Nema’s fondness for the letters “HM” in naming his companies, Azernekou often used the word “Lantern.”

He incorporated Red Lantern Co Ltd in Hong Kong on June 9, 2010 — the day the UN Security Council voted to crack down on Iranian financial and shipping enterprises — at Lippo Centre, also using formation agent Richful Deyong.

The company’s co-founders were Shahrzad Arabinarei (or Arabi for short), an Iranian residing in China, and Zhang Xiaopeng, a Chinese national. Incorporation papers list an address for all three in a North Beijing apartment block adjacent to the Sinopec Management Institute, a training facility for China’s largest state-owned oil refiner. Neither Deyong nor Arabinarei responded to requests for comment.

Financial records indicate Red Lantern did business with other obscure oil-related entities even before HMEA was formed.

According to Chinese company registries, in March 2011, the Red Lantern founders established a subsidiary in the Zhangjiagang Free Trade Zone, which is known for petrochemical imports. Azarnekou was the controlling shareholder. Nema’s Swedish citizenship made it easy to act as Azarnekou’s proxy in creating HMEA, Swedish officials noted in court papers, and HMEA’s Gmail account betrays their relationship: It conflates their names as “Ehsan Hatam.”

Cash was regularly transferred between their companies. Bank records show that Nema’s H.M. Import and Export paid 439,000 euros ($566,000) to Azarnekou’s Red Lantern Co Ltd, two months before HMEA’s incorporation.

Both Red Lantern entities were dissolved by August 2014, but four months later Azarnekou established 1001 Group Limited at Lippo Centre, and in 2017 he set up the Qeshm Partners (1001 Exchange), a money exchange near Bandar Abbas, Iran’s most important seaport.

Like Nema, Azarnekou is a hard man to find. Both list residential addresses in Dubai and their current locations are unknown.

Underworld Connections

Illustrating the truly global reach of the criminal world’s financial networks beyond the China-Iranian oil money pipeline, HMEA conducted transactions with entities headquartered across a wide range of jurisdictions, from Switzerland to Dubai, which were subsequently fined or blacklisted by the U.S. for violating sanctions. HMEA also made payments to Chinese and Indian companies accused of economic espionage and theft of trade secrets.

The true origins of the money that flowed through HMEA’s Asia-based shell companies remains unclear. However these networks had strong and proven links to major international money laundering operations and sanctions evasion.

HMEA received at least $130 million from a network of Hong Kong, Singapore, and British Virgin Islands-based shell and trading companies.

These obscure entities moved money predominantly through bank accounts in China, Thailand and Singapore, and involved interconnected networks of shareholders operating mainly from Yiwu City, a light manufacturing hub in eastern China.

These same networks also moved hundreds of millions of dollars for a wide variety of interests, including companies implicated in the Azerbaijani Laundromat and other money laundering schemes uncovered by OCCRP; on behalf of OFAC-sanctioned entities; and on behalf of companies directly associated with admitted money launderer Reza Zarrab.

The Azerbaijani Laundromat was a complex money laundering operation involving U.K.-registered shell companies that moved at least $2.9 billion between 2012 and 2014.

Many of the businesses were linked to high-level government officials and members of the Azerbaijani first family, and some of the money went to EU parliamentary officials who worked in Azerbaijan’s interest.

HMEA also sent at least $45 million to obscure Turkish and UAE firms that were controlled by Zarrab associates and linked to Dubai companies in Zarrab’s money-laundering scheme: Atlantis Capital General Trading, which transferred more than $1 billion to Iranian banks, and Hanedan General Trading, which moved $250 million through U.S. bank accounts.

Tehran’s Fingerprints

According to Swedish court records, Nema acknowledged that he provided money exchange services to the Iranian embassy in Stockholm, and that his major clients included Viewnet Enterprise AB, a Swedish safety and security company once hired by Iran’s Ministry of Road and Transportation in Tehran to install surveillance equipment.

Neither the embassy nor Viewnet responded to requests for comment.

The Iranian government’s exact relationship with HMEA is unclear.

The timing of the company’s formation, plus the scale of transactions, suggest that HMEA was part of a coordinated response to the increasing U.S. sanctions. Bank transaction records show that Chinese and Iranian oil companies used a number of other underground networks besides HMEA to move oil money during this period.

After the Obama administration suspended U.S. sanctions in stages in 2016, some of Iran’s underground financial networks went dormant. But the sanctions relief was short-lived. The Trump administration officially withdrew from the denuclearization deal in 2018, re-imposed sanctions, and placed even tighter restrictions on Iran’s oil trade.

Last year, the U.S. blacklisted a Chinese state-owned oil trading company and its CEO for buying Iranian oil. Two tanker operators belonging to China’s largest shipping company were also sanctioned.

The Lippo Centre-based network of companies uncovered by this investigation, as well as Red Lantern in Tehran, had all been dissolved by February of this year.

But that doesn’t mean these networks are gone.

“It’s impossible to tell whether, on balance, sanctions evasion transactions through the global banking system have increased or decreased in recent years,” said Jessie Liu, a former U.S. Attorney involved in the 2019 prosecution of Standard Chartered bank for Iran sanction violations.

“On the one hand, banks are implementing more stringent know-your-customer and compliance programs,’’ she said. “On the other, sanctions evasion schemes have become even more sophisticated, aided by the growth of virtual currencies, which are increasingly being embraced by large banks.”

Continuing deterioration of Tehran’s relations with the West means that use of such schemes will likely increase, as will its reliance on China.

The Financial Action Task Force, an international anti-money laundering watchdog, accused Iran of failing to counter “terrorist financing risks” and reimposed countermeasures that effectively blacklist the country earlier this year.

Contributors include Martin Young,Kelly Bloss, Šarūnas Černiauskas, Jason Papakheli, Aparna Surendra and Eric Barrett and Roshanak Taghavi of OCCRP and Joachim Dyfvermark and Linda Larsson Kakuli of SVT.

Article Credit: https://www.courthousenews.com/the-quiet-man-in-stockholm-who-laundered-chinas-oil-money-for-iran/